Introduction

In the ever-evolving world of technology, the Software as a Service (SaaS) industry stands out as a beacon of innovation and growth. SaaS companies provide cloud-based software solutions to customers across various industries, offering convenience, scalability, and flexibility. While many metrics help evaluate the health and sustainability of a SaaS company, the “Rule of 40” has become a key benchmark. In this blog, we’ll dive deep into the Rule of 40, its significance in the SaaS realm, and how it shapes the future of this dynamic industry.

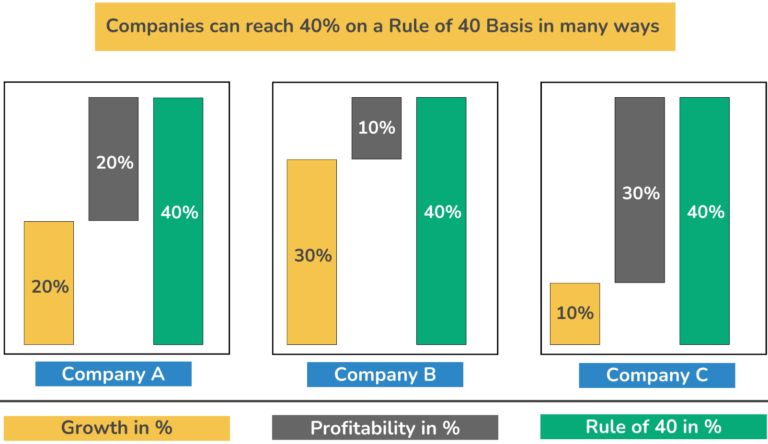

The Rule of 40 is a financial performance metric that serves as a litmus test for SaaS companies. It’s a simple equation:

In this formula, the “Revenue Growth Rate” is the annual growth rate of a SaaS company’s revenue, and the “profitability margin” represents the company’s operating profitability. The Rule of 40 suggests that a healthy SaaS company’s combined revenue growth rate and profit margin should be equal to or exceed 40%. Let’s break down this equation to understand its significance:

- Revenue Growth Rate: A strong revenue growth rate is a hallmark of a successful SaaS company. This metric measures how rapidly a company is acquiring new customers, expanding its user base, and increasing sales. SaaS businesses often prioritize rapid growth, aiming to capture market share and build a customer base. While growth is crucial, it should be sustainable and not come at the cost of profitability.

- Profit Margin: Profit margin reflects how efficiently a SaaS company operates. It calculates the percentage of revenue that remains as profit after covering operating expenses. A healthy profit margin signifies a company’s ability to control costs, optimize resources, and generate profit. A high margin indicates operational efficiency and robust financial health.

EBITDA

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric that focuses on a company’s operational profitability. It excludes non-operating expenses like interest and taxes, providing a clear view of core business performance. By omitting depreciation and amortization, EBITDA offers insights into a company’s cash-generating capacity from operations. This metric is useful for industry comparisons and assessing a firm’s ability to manage debt. However, it has limitations and is often combined with other measures for a comprehensive financial analysis.

EBITDA margin serves as the preferred profitability measure for SaaS firms, eliminating non-operating variables for better comparability. Though net income or cash flow are alternative metrics, the Rule of 40 relies on revenue growth and EBITDA margin. Profit margin signifies cost control and financial health, with high margins indicating operational efficiency.

Why the Rule of 40 Matters

The Rule of 40 is more than just a mathematical equation; it’s a barometer for the overall health and sustainability of a SaaS company. Let’s explore why it matters:

- Balancing Growth and Profitability: In the early stages, SaaS companies may focus on aggressive growth to capture market share and become industry leaders. However, sustained growth without achieving profitability can lead to financial instability. The Rule of 40 encourages companies to strike a balance between growth and profitability. It acts as a reminder that growth should not come at the cost of losing money.

- Investor Confidence: Investors, particularly venture capitalists and private equity firms, often use the Rule of 40 as a screening tool when considering investments. Companies that meet or exceed the Rule of 40 are generally seen as less risky and more attractive investments. Achieving this benchmark can open doors to funding opportunities, fueling further growth.

- Focus on Efficiency: The Rule of 40 underscores the importance of operational efficiency. SaaS companies are encouraged to find ways to control costs and maximize profitability. This focus on efficiency benefits not only investors but also customers and employees. Efficient companies can provide better products and services at competitive prices, which ultimately leads to customer satisfaction and retention.

Graphic 1:Three ways of Companies reaching Rule of 40

The Weighted Rule of 40

Amid shifting market dynamics, SaaS companies have favorized the Weighted Rule of 40, a new metric that prioritizes growth, especially for smaller players seeking rapid expansion and places more significant weight on growth compared to profitability, in tune with investor appetites.

For smaller SaaS firms, focusing on growth aligns with strategic goals of capturing market share and attracting investment. It guides pricing strategies and resource allocation. However, the Weighted Rule of 40 remains adaptable for mature companies, enabling an emphasis on profitability as they navigate varying growth phases.

Investor preferences increasingly lean toward companies excelling under this metric, with high-performing firms like Okta, Adobe, Zoom, Twilio, and Datadog enjoying greater attention and revenue multiples. It has become an essential tool for SaaS companies to align their strategies with market trends and enhance their future valuations.

Challenges of Achieving the Rule of 40

While the Rule of 40 is a valuable metric, achieving and maintaining it can be challenging for SaaS companies. Several factors can impact a company’s ability to meet this benchmark:

- Market Saturation: In mature markets, where competition is intense and customer acquisition becomes more challenging, it may be difficult to maintain high revenue growth rates. SaaS companies often need to explore new markets or diversify their product offerings.

- Economic Downturns: Economic downturns can significantly affect SaaS businesses. Reduced budgets and tighter spending by customers can slow down revenue growth. It’s important for SaaS companies to be resilient and adaptable during economic uncertainties.

- Balancing Costs: As SaaS companies grow, they may encounter scaling challenges. Balancing the need for additional resources and investment in growth with profitability can be complex. It requires strategic decision-making and prudent financial management.

- Customer Retention: Customer churn can erode revenue growth. SaaS companies must focus on customer retention strategies to keep existing customers and minimize attrition. Customer success and satisfaction play crucial roles in achieving the Rule of 40.

Graphic 2: Challenges of Achieving the Rule of 40

Summary

The Rule of 40, weighted or not, has become a fundamental benchmark for evaluating the health and sustainability of SaaS companies. It encourages SaaS businesses to strike a balance between rapid growth and profitability, while also emphasizing the importance of operational efficiency. Meeting or exceeding the Rule of 40 can instill investor confidence, drive funding opportunities, and ultimately lead to long-term success in the competitive SaaS landscape.

As the SaaS industry continues to evolve, the Rule of 40 will remain a key metric guiding companies towards profitable growth and ensuring that they navigate the cloud with resilience and foresight. It is a reminder that in the dynamic world of technology, success is not only about innovation but also about financial prudence and strategic execution.