Situation

Investors are increasingly demanding transparent communication of the implications of corporate actions for the environment and society, as well as their consequences for the business model, as part of ESG (environmental, social and governance) reporting.

Significant developments are also currently taking place at the regulatory level and among various private sector organizations that will impact future reporting practices on ESG aspects. This article provides an overview of the increasing information needs of investors, highlights the integration of ESG into the finance function, and outlines key developments in ESG reporting.

Leonard Clemens, Co-founder and Managing Partner of Cadence Growth Capital (CGC), a growth equity firm investing in tech-enabled businesses in the DACH region, notices the majority of LPs weaving ESG considerations into their investment decision criteria. “ESG is an LP-driven phenomenon, and if you are in Europe, you are hearing about it every day” says Clemens. “Surveys show that an overwhelming majority of LPs are ready to walk away from an investment based on ESG criteria performance with environmental issues being the key focus for European LPs.”

“We aim to be pragmatic in our approach to integrating ESG across our investment cycle as well as empower our portfolio companies to implement ESG initiatives. With our shareholding in everphone, a device-as-a-service provider, we are participating in a circular economy with everphone playing an essential role in reducing carbon footprint by recycling and refurbishing electronic devices thus extending their lifetime and saving approx. 58kg of CO2 per device. In 2020, 226 million smartphones were refurbished worldwide saving 13 million tonnes of CO2 which is equivalent to the annual emissions of 8.7 million combustion cars.”

“We will remain committed to leading ESG efforts within our investment cycle as we consider the positive impact we can achieve as central to our business strategy” concludes Clemens.

Leonard Clemens, Co-founder and Managing Partner of Cadence Growth Capital (CGC), a growth equity firm investing in tech-enabled businesses in the DACH region, notices the majority of LPs weaving ESG considerations into their investment decision criteria. “ESG is an LP-driven phenomenon, and if you are in Europe, you are hearing about it every day” says Clemens. “Surveys show that an overwhelming majority of LPs are ready to walk away from an investment based on ESG criteria performance with environmental issues being the key focus for European LPs.”

“We aim to be pragmatic in our approach to integrating ESG across our investment cycle as well as empower our portfolio companies to implement ESG initiatives. With our shareholding in everphone, a device-as-a-service provider, we are participating in a circular economy with everphone playing an essential role in reducing carbon footprint by recycling and refurbishing electronic devices thus extending their lifetime and saving approx. 58kg of CO2 per device. In 2020, 226 million smartphones were refurbished worldwide saving 13 million tonnes of CO2 which is equivalent to the annual emissions of 8.7 million combustion cars.”

“We will remain committed to leading ESG efforts within our investment cycle as we consider the positive impact we can achieve as central to our business strategy” concludes Clemens.

Challenges & Opportunities

The amended regulations are to apply to financial years beginning on or after January 1, 2023. However, capital market-oriented SMEs are to be granted an additional preparation period. For them, application of the amended CSR Directive is not planned until three years later than for large companies (January 1, 2026).

Not only investors and public authorities are demanding ESG compliance, but also young talents are more and more conscious of their employee being a company of purpose and sustainability.

That puts leadership teams of SMEs and in particular CFOs under the challenge to quickly embrace the topic and set-up an ESG management within their company incl. internal and external reporting & communication of their ESG compliance. Even more ESG initiatives need to be set-up to quickly comply with the ESG standards.

Not only investors and public authorities are demanding ESG compliance, but also young talents are more and more conscious of their employee being a company of purpose and sustainability.

That puts leadership teams of SMEs and in particular CFOs under the challenge to quickly embrace the topic and set-up an ESG management within their company incl. internal and external reporting & communication of their ESG compliance. Even more ESG initiatives need to be set-up to quickly comply with the ESG standards.

Key questions for Tech CFOs:

- What are the most important KPIs in the ESG space to be fulfilled by my company?

- How does “good” look like? Where do I get benchmarks as basis for target setting of my ESG initiatives?

- Where do I get the reporting information from in the most efficient way – ideally via automated APIs to operational systems?

- How can I quickly set-up policies within my organizations – as required by ESG? Where do I get reliable templates?

- How to set-up and run an ESG management process incl. ESG dashboards and initiatives in the most efficient – meaning digital way?

Solution

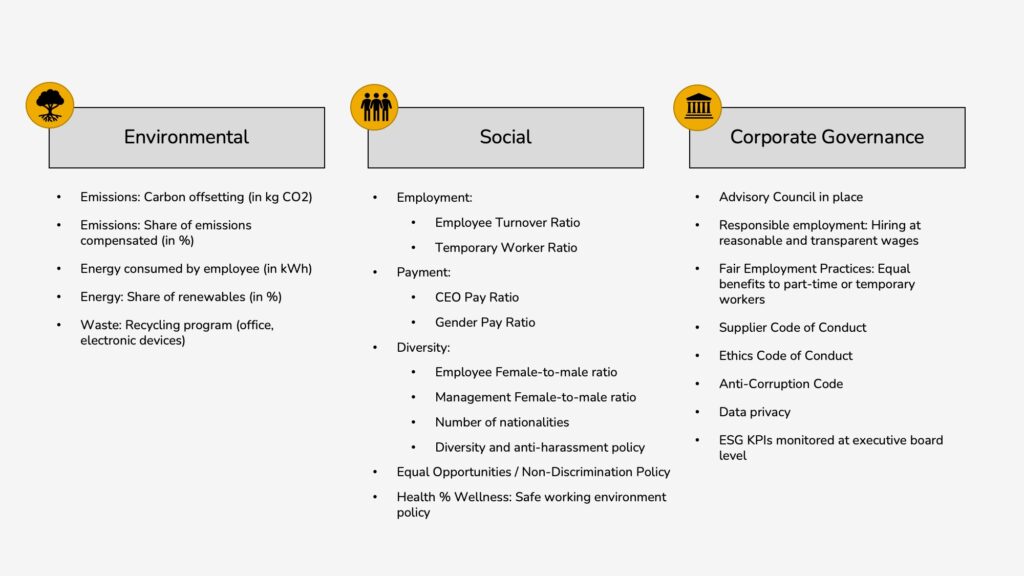

We have derived the right Key Performance Indicators (KPIs) from the UN sustainability standards and the works from the Global Reporting Initiative (GRI; https://www.globalreporting.org/) that provides guidance to companies about the ESG standards incl. definitions and metrics.

This resulted the following set of KPIs relevant for Tech companies:

This resulted the following set of KPIs relevant for Tech companies:

Figure 1: Relevant KPIs for ESG reporting of Tech companies

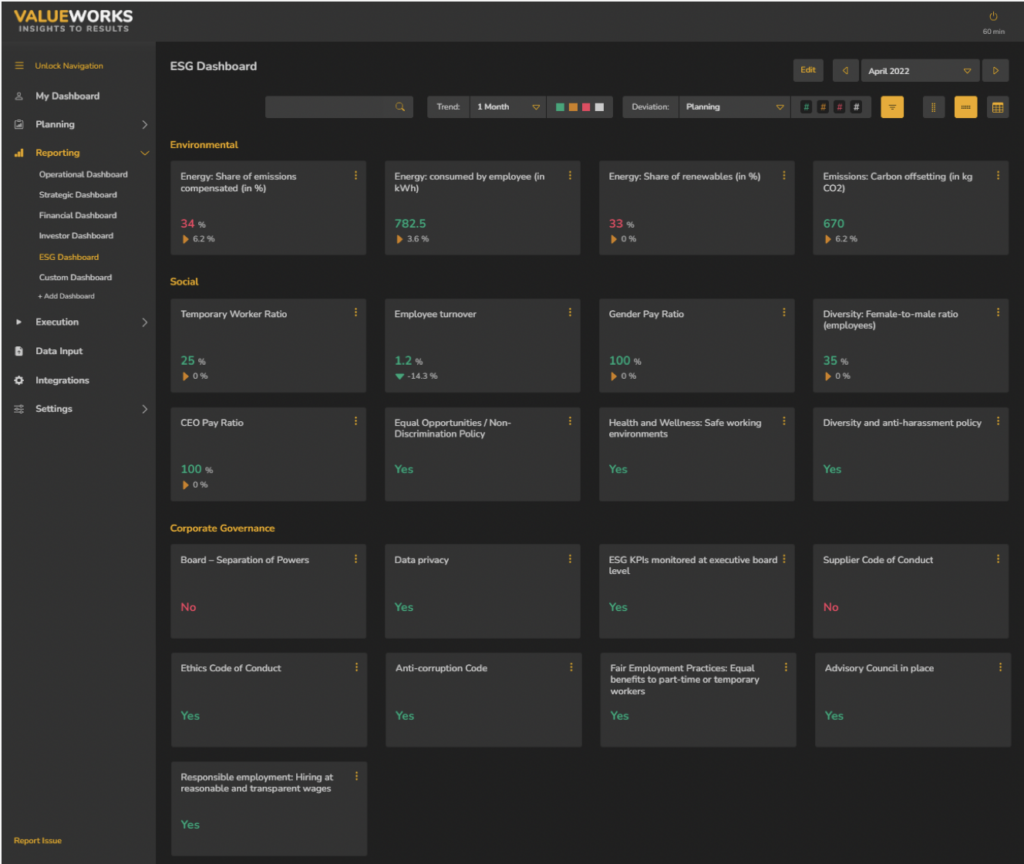

The ESG dashboard shows the defined KPIs in a simple and easy to understand way. Ideally, the ESG dashboard is not stand-alone, but already part of the Management & Investor reporting system as key and integral element to govern the company.

Figure 2: ESG dashboard (example ValueWorks)

The figure above shows benchmark values already incorporated in the ESG dashboard to calibrate the internal performance and provide an orientation for meaningful goal plan setting. The color coding of the actuals should already indicate whether the planning values or external benchmarks are met.

Automated interfaces to operational systems are crucial to run the ESG reporting process in an efficient way.

Automated interfaces to operational systems are crucial to run the ESG reporting process in an efficient way.

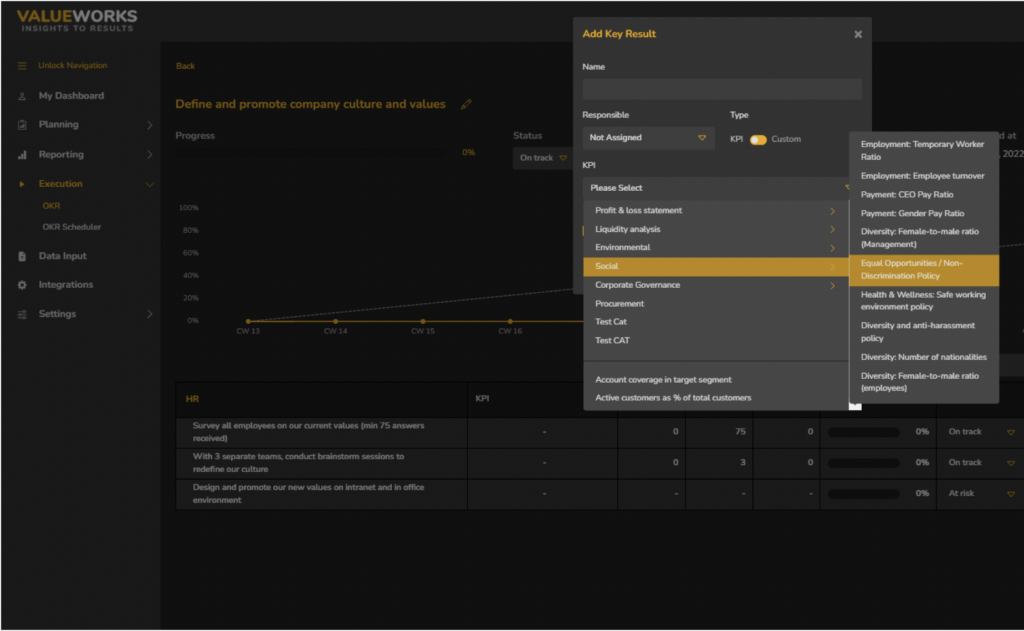

- Environment KPIs: At tech companies, major contribution of emission coming from Cloud providers and business travel. Therefore, integration with Cloud providers’ emission reporting and Travel & Expense Management system helps to update KPIs automatically

- Social KPIs: Major data source for automated reporting is the HR system

- Corporate Governance: Most KPIs reflect the compliance with “policies” by employees or suppliers. Therefore, survey tools can be integrated to automatically track compliance

Figure 3: OKR module accessing ESG KPIs for ESG initiative tracking

Summary

ESG can be set-up and managed in an efficient way by Tech companies by leveraging APIs operational systems for automated reporting and by integrating the ESG management in the standard reporting for Management & Investors and OKR processes.

Addressing the topic early on helps to be proactive with investor and public authorities. Also the information from the ESG dashboard is a good basis for internal and external communication to talents.

Addressing the topic early on helps to be proactive with investor and public authorities. Also the information from the ESG dashboard is a good basis for internal and external communication to talents.