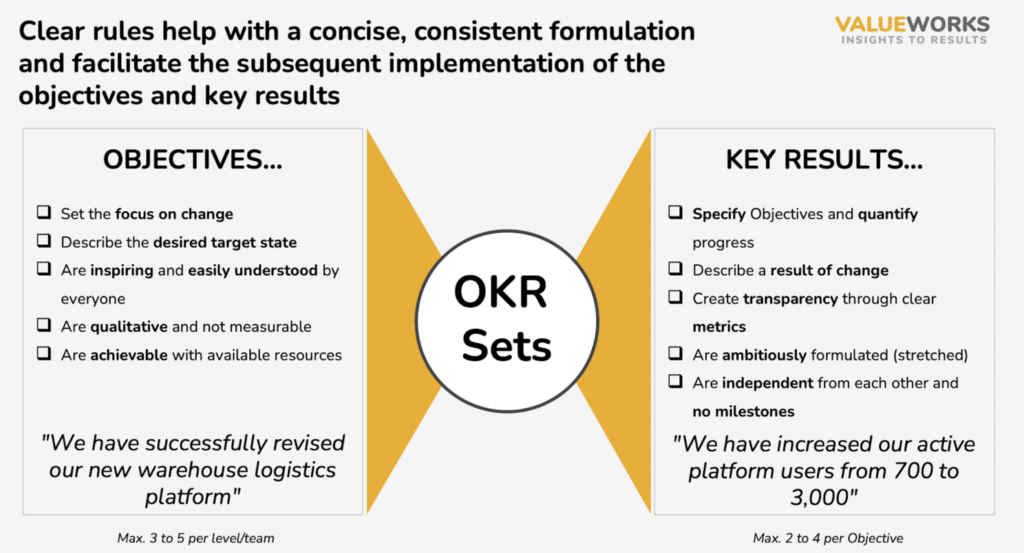

In this article, we discuss the difference between OKR 1.0 and OKR 2.0. The OKR framework breaks down the corporate strategy into clearly defined “Objectives” and “Key Results”. While the “Objective” describes the desired target state and is mostly qualitative, the related “Key Results” provide a quantitative measurement and metrics for progress. In recent years, OKR is on its way to become a standard management method. However, the current OKR 1.0 approach has significant shortcomings and lacks a suitable set of tools for effective OKR management. We have further developed the OKR methodology to “OKR 2.0” and addressed the current challenges.

Background

The OKR methodology is a goal setting framework used by individuals, teams and organizations to define measurable goals and track their outcomes. While the originated from John Doerr from Intel, it has become very popular with Google adopting the principles and further tech companies following. In the recent years, OKR is on the way to become a standard management methodology.

While the “Objective” describes the desired target state and is mostly qualitative, the related “Key Results” provide a quantitative measurement and metrics for progress.

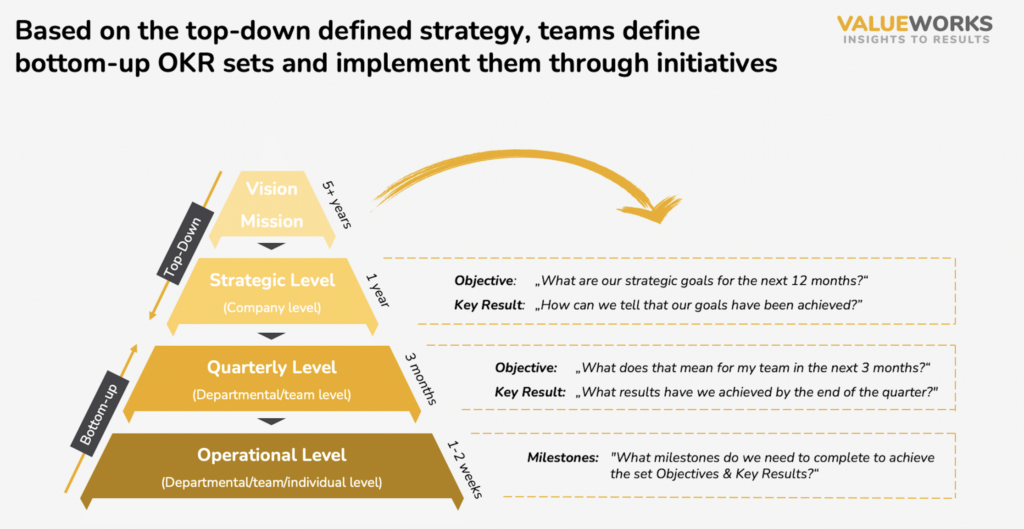

The OKR framework breaks down the corporate strategy into clearly defined “Objectives” and “Key Results”. Therefore, the vision & mission is translated by the leadership team into strategic goals on company level with 1 year time horizon. Based on the top-down defined strategy, departments/teams define bottom-up OKR sets (on quarterly basis) and implement them through milestones.

The Challenge

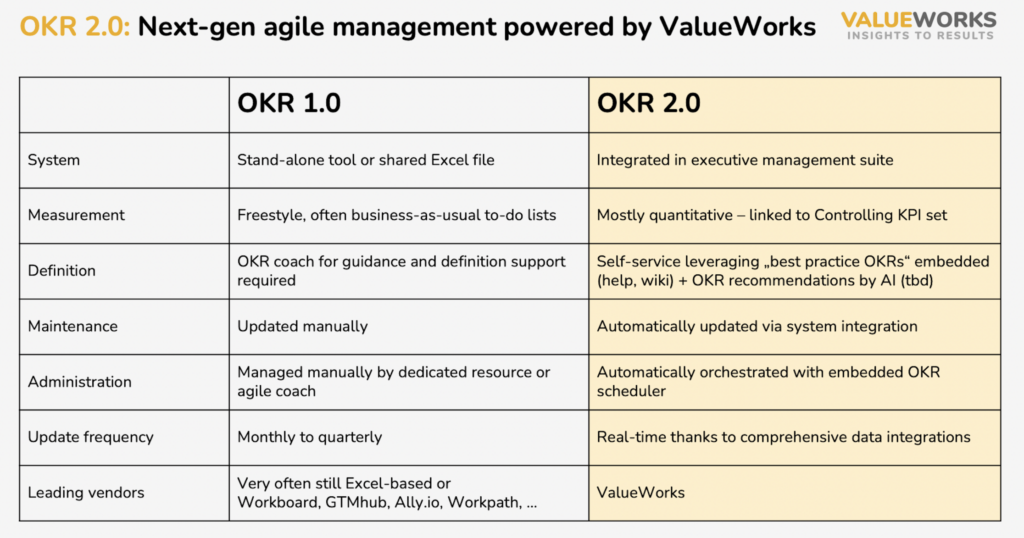

In recent years, OKR is on its way to become a standard management method. However, the current OKR 1.0 approach has significant shortcomings and lacks a suitable set of tools for effective OKR management. To ensure lasting success of OKR management, these problems must be addressed.

In particular, the separation and high level of reconciliation between controlling and OKR is a constant challenge for many CFOs. Often, the figures in the OKR system do not match the figures (actual, target) in management reporting and thus do not correctly reflect the implementation status of an organization.

Our Solution: OKR 2.0

We have further developed the OKR methodology to “OKR 2.0” and addressed the current challenges:

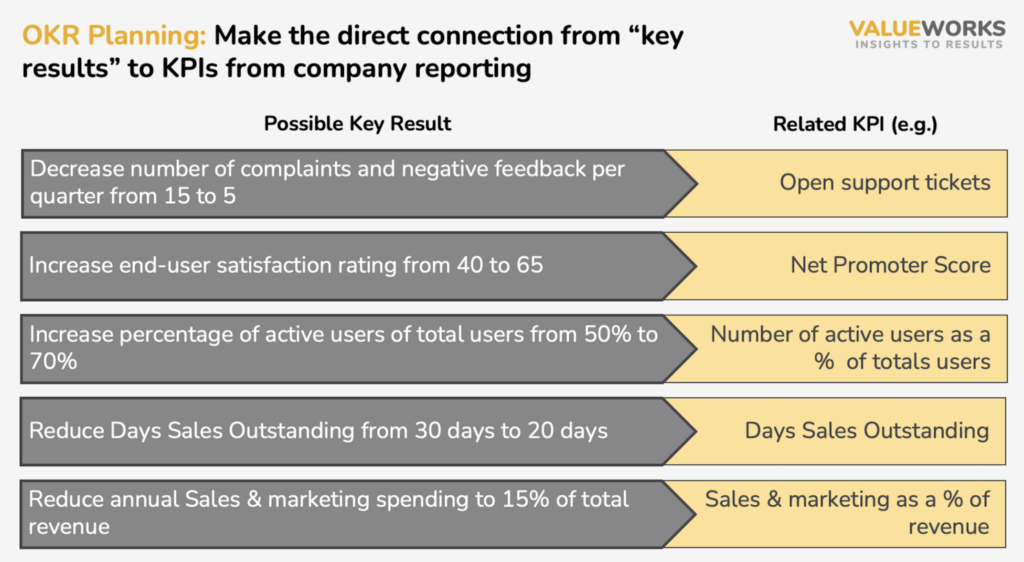

Controlling and OKR does not need to be two separate silos. Strategic, operational, and financial KPIs (and ESG metrics) can be leveraged to define a possible “Key Result”. See the table below for same tangible examples:

The secret behind OKR 2.0 is to leverage the existing integrations to operational systems and the related standard KPI library for the OKR module. To measure “Key Results” now also KPIs from the Reporting module can be selected.

As effect, actuals are reported automatically and on an ongoing basis – without the need to verify the numbers. In addition, user still have the option to define custom “Key Result”” with the possibility to convert them into KPIs later on.